5、 Current situation in China

A. Consumption

With the accelerated pace of people’s life in recent years, China’s instant noodle industry has developed rapidly. In addition, the emergence of high-end instant noodle products that pay more attention to business and health in recent years, China’s instant noodle consumption has been growing. The emergence of the epidemic in 2020 has further promoted the growth of the consumption of instant noodles in China. With the effective control of the epidemic, the consumption has also declined. According to data, the consumption of instant noodles in China (including Hong Kong) will reach 43.99 billion in 2021, a year-on-year decrease of 5.1%.

B. Output

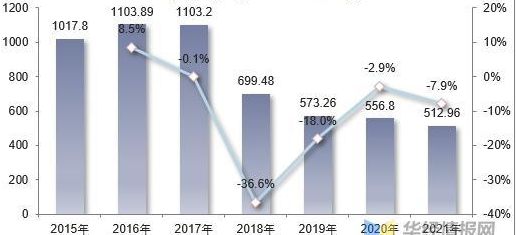

In terms of output, although the consumption of instant noodles in China is on the rise as a whole, the output is on the decline as a whole. According to data, the output of instant noodles in China will be 5.1296 million tons in 2021, down 7.9% year on year.

From the distribution of China’s instant noodle production, as wheat is the main raw material for instant noodle production, China’s instant noodle production is mainly concentrated in Henan, Hebei and other provinces with large wheat planting areas, while Guangdong, Tianjin and other regions are also distributed due to the fast pace of life, large market demand, complete industrial facilities and other factors. Specifically, in 2021, the top three provinces in China’s instant noodle production will be Henan, Guangdong and Tianjin, with the output of 1054000 tons, 532000 tons and 343000 tons respectively

C. Market size

From the perspective of market size, with the continuous growth of China’s instant noodle consumption demand in recent years, the market size of China’s instant noodle industry has also been increasing. According to data, the market size of China’s instant noodle industry in 2020 will be 105.36 billion yuan, up 13% year on year.

D. Number of enterprises

According to the situation of instant noodle enterprises in China, there are 5032 instant noodle related enterprises in China. In recent years, the registration of instant noodle related enterprises in China has fluctuated. During 2016-2019, the number of registered enterprises in China’s instant noodle industry showed an upward trend. In 2019, the number of registered enterprises was 665, which was the largest in recent years. Later, the number of registered enterprises began to decline. By 2021, the number of registered enterprises will be 195, down 65% year on year.

6、 Competition pattern

Market pattern

From the market pattern of China’s instant noodles industry, the market concentration of China’s instant noodles industry is relatively high, and the market is mainly occupied by such brands as Master Kong, Uni President and Jinmailang, among which Master Kong is subordinate to Dingxin International. Specifically, in 2021, the CR3 of China’s instant noodle industry will be 59.7%, of which the international market of Dingxin will account for 35.8%, the market of Jinmailang will account for 12.5%, and the unified market will account for 11.4%.

7、 Development trend

With the growth of people’s income and the continuous improvement of living standards, consumers have put forward higher requirements for the quality, taste and diversity of instant noodles. This change in demand is both an imminent challenge and a good opportunity for instant noodle enterprises to regain their position. Under the increasingly strict food safety supervision system in China, the industry threshold has been gradually raised, which has promoted the survival of the fittest in the instant noodle industry. Only by constantly developing new products and meeting the changing consumer demand can instant noodle enterprises survive and develop in the fierce competition in the future. The overall level of the instant noodle industry has been improved, which is conducive to the sustainable, stable and healthy development of the industry. In addition, the circulation format of the instant noodle industry has been in the process of continuous change. In addition to traditional offline channels such as distributors and supermarkets, online channels are also playing an increasingly irreplaceable role. Online channels break the original model, directly connect manufacturers and consumers, reduce intermediate links, and facilitate consumers to obtain product information more easily. In particular, the newly emerging short video, live broadcast and other new formats provide diversified channels for instant noodle manufacturers to promote their brands and products. The coexistence of online and offline diversified channels is conducive to expanding the industry’s sales channels and bringing more business opportunities to the industry.

Post time: Oct-31-2022